What next for Next

The best-managed retailer in the UK just keeps bringing us good news and wise thoughts.

Hi folks,

This evening, I want to give you a review of the Q2 update from Next (NXT).

Disclosure: I have a long position in Next.

This is a share I’ve held since March 2017. I must admit to being influenced by my fantastic Stockopedia co-writer Paul Scott, a retail specialist, who had remarked on what a high quality business it was.

Being a rather boring investor, I bought the shares in two tranches, and have done nothing with them since.

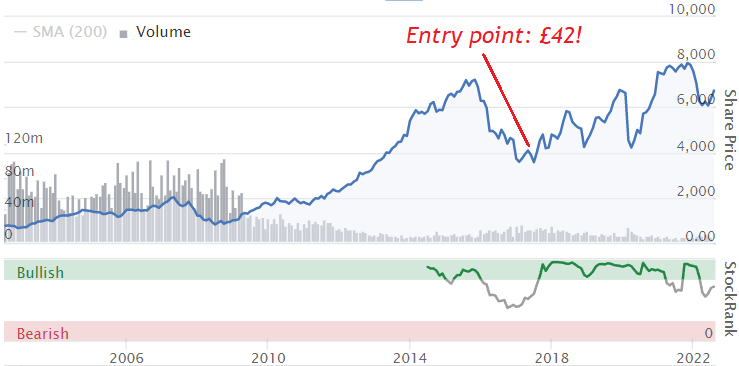

My average entry was £42. The shares currently change hands at £67:

A gain of 59% is perhaps not so spectacular - many of you have likely achieved more in a matter of weeks, with some of your investments.

But Next has also been a big dividend payer - excellent cash generation and balance sheet management allows for this - and I’ve received £9.57p per share in dividends.

On top of that, the Next share count has declined and I now own 14% more of the company than I did when I invested in it!

By the way, nearly all of the companies in my personal portfolio have recently bought back their own shares. To view my buyback-themed portfolio and its recent performance, click here and sign up for Monopoly Investor membership.

All told, my return from investing in Next is 81%, or nearly 12% annualised. A highly successful investment so far.

What next for Next

It’s all very well to say that the company has done a fine job - which it has.

Like good investors, the management prepared a strategy to reduce their retail footprint to nothing, if necessary. Instead of being victims of the economic winds, they were ready to adapt their business, depending on what happened.

And what happened? Store numbers gradually declined, while online sales soared (helped by lockdowns in the most recent two years).

All of which brings us to today’s trading statement.

The key point? Things have returned to normal:

Sales in the first half of the year have been dominated by a sharp reversal of last year's lockdown trends. Sales in Retail stores recovered, while Online growth appears to have reverted back to its longer term trajectory. Many product trends have also returned to pre-pandemic norms. Lockdown winners such as Home and sportswear retreated, while formalwear returned to favour. As anticipated, Online returns rates and surplus stock also reverted to pre-lockdown levels.

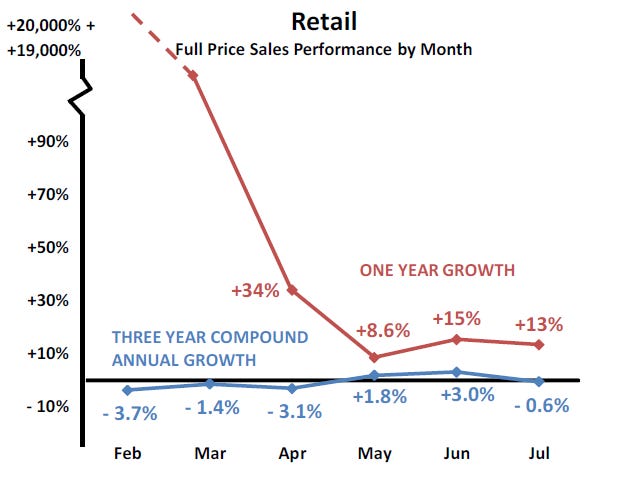

In a chart of its own, the company shows that Online sales are down compared to last year, but up compared to three years ago.

Note that the three-year performance in blue is a compound growth rate, e.g. 15% compounded for three years is a gain of 52%!

The point being made is that lockdowns might have created a mess on a one-year view, but now that they are gone, the “return to normal” shows a long-term trend that makes a lot more sense.

Normality is confirmed by the returns rates (42%) and the quantity of stock going for sale both back roughly in line with historical norms.

And it’s the same story when you look at Retail stores. The one-year growth make little sense, but the three-year growth rates are about what you’d expect (i.e. little or no growth, and declining when inflation is taken into account):

One other point about the Retail stores is worth mentioning. Next includes this little nugget:

We suspect that the apparent improvement in the fortunes of our stores is, to some extent, down to the number of competing stores that have closed in the last three years. This is supported by ONS industry statistics for February to June which suggest that the total money spent on clothing in all UK retail stores is down -6% compared to three years ago.

Wow!

Even the most ardent believer in the shift to online shopping would likely accept that some retail stores in the busiest locations must survive - some people still like trying on clothes and seeing what they look like, before they buy them!

If it’s convenient to visit a store, you can have your clothes the very same day, without even needing to wait for delivery. It’s easy to forget that real-life shopping still has some merits!

It turns out that after all the carnage in the retail sector, Next is still here and is even benefitting from the collapse. One of the last men standing, if you will.

Conclusions? I won’t bore you with too many numbers, but Next has raised its pre-tax profit guidance for the year by £10m, to a new central estimate of £860m. The company remains cautious (rightfully, I think) due to a belief that H1 was unduly boosted by weather and that inflation is going to hurt consumer demand.

The company’s market capitalisation is £8.7 billion this evening. I’ve been holding it for five years, and I’d love to hold it for another five.

What do you think? Let me know in the comments!

Best regards

Graham

PS: I’d really appreciate if you could again hit the “heart” button, to let me know you enjoyed this article. Thank you!

agree all