Football fans understand the principal-agent problem better than most

Finding the right people for the right job is surprisingly difficult.

We are deep into summer and most football stadiums are quiet, as preparations continue for the new Premium League season.

What does that have to do with the stock market, I hear you ask?

Well, for one thing, shares in Manchester United can be bought and sold on the New York Stock Exchange: Manchester United Plc (NYSE:MANU).

Fans of the much better club Tottenham Hotspur have access to an auction facility on AssetMatch.

Arsenal, Liverpool and Manchester City were all previously traded on JP Jenkins, but those facilities are no longer available. Scottish club Rangers has also been traded, from time to time.

Do football clubs make for good investments? In one word: no. Which is perhaps surprising, given their literal armies of loyal customers.

The Strange Case of Manchester United

Manchester United was listed in 2012, at an IPO price of $14 per share. As you can see, it hasn’t achieved much for shareholders, beyond the dividend stream. More on that later.

The club has 163 million shares outstanding, of which 120 million are special and known as “B” shares.

All of these special shares are owned by the children of Malcolm Glazer, often referred to by fans as The Glazers.

And while the B shares have no special entitlement to dividends, they do enjoy ten times as many votes as the “A” shares.

Because of this, the Glazers control 96.7% of votes at Manchester United, despite owning less than 75% of the total number of shares.

A club in trouble?

Financially, things aren’t much better.

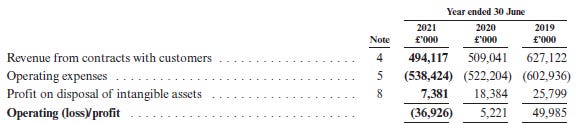

As performances on the pitch have deteriorated in recent years, revenues have fallen, and profitability has suffered:

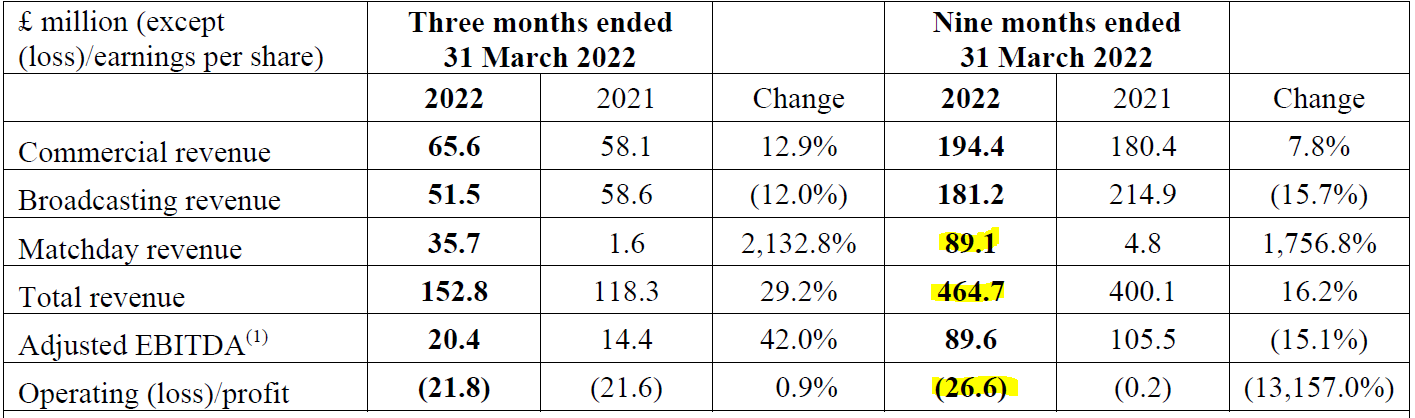

Crowds returned to football matches in the most recent financial year, helping the revenue performance to improve. However, expenses weren’t controlled and the company made another operating loss in the nine months ending March 2022:

And while all of this is happening, the club sits under a debt mountain. Net borrowings are just shy of £500 million.

The steady dividends are worth £24 million per annum, but with net debt/EBITDA in the region of 4x, I suspect that they will soon become inappropriate - unless profitability can improve.

An investing lesson

Football clubs aren’t known to be good investments, so perhaps none of this should be surprising.

But let’s take a fan perspective, and see how it might apply to companies in general.

This morning, Mark Goldbridge (that’s a stage name) said the following in the context of Man United’s botched transfer window:

Why we fail? Because we haven’t got people who care about the club. If I was in charge, there’s no way we’d be here on July 27th, going “it’s not going too badly, let’s just keep trying”. I’d be absolutely fuming… We’ve got people - John Murtough’s not a Man United fan, he came from Everton. Richard Arnold prefers rugby. The Glazers don’t even like football. The reason why we fail as a football club is if you haven’t got obsessive owners or CEOs or directors of football, who actually care about the club, they’re just paid workers… This lot? Realistically, it gets to end of the month, they’re just checking their bank accounts to make sure the wages go in. It’s a paid job to them. They’re not actually as engrossed in this as a fan would be.

When I heard this, I instantly thought of the management lessons I’ve learned from small-cap and mid-cap investing. The basic problem is: how can shareholders get management teams to work in their best interests?

The answer to the problem is not to pay higher salaries. That rarely helps, and may even exacerbate the problem.

The solution, instead, is to look for the right type of people.

Ideally, the people you want at the top of your company are obsessives. People who’ve devoted their lives to understanding their industry, people who know what it’s like to be a customer, and people who would do their job even if their salary was cut by 50% - because it’s not about the salary for them and because they couldn’t imagine doing anything else with their time.

That’s not the norm in any industry, in any part of the world. But when you find these people, don’t forget about them - and try to invest alongside them.

Otherwise, you might find yourself battling it out with West Ham to avoid the Europa Conference League. And nobody wants that.

Best regards,

Graham

PS: Thanks for reading. To support this newsletter, please hit the “heart” button to show that you enjoyed the article! Thank You.

An interesting article.

I wouldn't buy shares in a football club, primarily due to the "prune juice effect", as memorably described by Lord Sugar. Who once owned some naff club in London :).

HOWEVER, Michael Knighton had an agreed deal to buy Manchester United in 1989 for £20 million.

Chelsea have bust been bought for a reported $4 billion.

Even if we assume that's crazy and value a the larger Manchester United brand at £2 billion, that's a 100 bagger. A 15% CAGR.

I'm still not buying shares in football clubs. I suspect the next 30 years will not be as good as the last 30 years.

Excellent, thought provoking analysis, as usual Graham