Fever-tree is still fizzing

Five years from now, nobody will remember the glass shortage of 2022.

For a long time, tonic water was a boring and overlooked sector.

Schweppes was the default choice, and none of the alternatives ever posed much of a challenge.

Schweppes got too comfortable. It didn’t see the threat posed by Fevertree Drinks (FEVR), which did the unthinkable, and usurped its position as the #1 tonic water brand.

The Psychology of Tonic Water

Tonic water is a curious product, when you think about it: it’s a drink you must combine with something else - something far more interesting, like gin!

People like to experiment with the “something else”. But they don’t really want to experiment with the tonic water.

This makes it inevitable that a small number of tonic water brands will have very high market share. You have the “default” brands, and then “the rest” (including all the cheap, supermarket labels).

Riding industry trends

Much of Fever-tree’s success can be traced to the “premiumisation” of the beverage industry.

While alcohol consumption in general is declining, people are willing to spend big on alcohol, when they have an occasion to do so!

That’s important, because Fever-tree is more than twice the price of Schweppes in supermarkets (and many times the price of supermarket own-brands).

That hasn’t stopped Fever-tree finding customers willing to pay for the improved flavour, like this gin connoisseur:

According to FEVR’s 2021 Annual Report, quoting figures from Nielsen, Fever-tree now has the number one position in the United States for value share in tonic water.

In Canada, Fever-tree already had the number one spot.

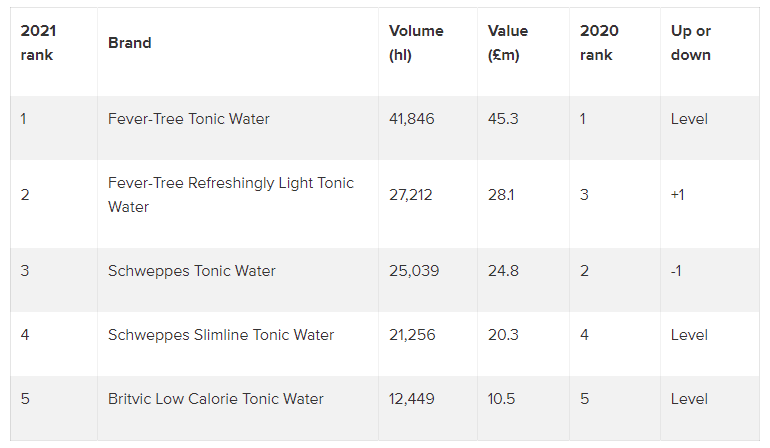

And there is no question about who is leading in the UK:

Looking ahead, the strategy is refreshing simple: more of the same.

The company’s success has bred competitors in the premium mixer category (e.g. Double Dutch), but they don’t enjoy the first-mover advantage that enabled Fever-tree to build tremendous scale and name recognition.

So what will it take to topple Fever-tree? Schweppes have struggled for ideas, and don’t seem to have come up with a viable strategy.

And if they don’t topple Fever-tree, then a smaller challenger - much smaller - will have to do it. Not impossible, but very difficult!

What’s the catch?

I’ve not mentioned the Fever-tree share price yet. This share has cratered over the past 12 months and reached multi-year lows:

The reasons for the collapse, in my view, are simple enough:

Annual revenues from the mature UK market are no longer reaching new highs, proving that there are limits to growth.

Input price inflation and other economic challenges are hurting profitability.

When a high-growth, highly-valued company becomes perceived as low-growth, and its earnings estimates are slashed, it’s inevitable that its share price will take a big hit.

But I’m starting to wonder if the market has over-reacted.

For years, the nosebleed valuation put me off buying these shares. Here is the historic price to sales multiple:

You can see that the price to sales multiple at Fever-tree was absurd for a long time. But now it’s just 3x. Not bad!

Disaster profit warning?

I would also note that in the disastrous RNS last week which caused the share price to crash, the company reported that sales were still growing at a respectable 14%, as Europe took up the slack for a modestly-growing UK segment.

In the US, arguably its biggest opportunity, Fever-tree said that “port congestion and labour shortages culminated in inventory shortages impacting sales towards the end of the period”. Demand was said to remain “very strong”.

This reminds me of when a company I was studying could not meet the very high demand for its products. Because of this it suffered some complications, and ended up issuing a “good” profit warning. This created a lovely buying opportunity:

I wouldn’t go so far as to say that Fever-tree’s profit warning is a “good” one - the lack of availability of both glass and labour, and rising freight costs, are all serious issues.

And with a market cap of c. £1,070 million at the latest share price of 920p, the EBITDA forecast of £37.5 million - £45 million for 2022 may not be enough to support the valuation in the short-term.

But does that really matter? Shortages of glass and labour, and rising freight costs, are unlikely to be permanent. Five years from now, will anybody remember the glass shortage of 2022?

Fever-tree’s co-founder and CEO has just spent £1 million increasing his stake in the company. That’s a nice signal and unlikely to be contrived, in my view.

So what do you think? Is Fever-tree a buying opportunity, or a falling knife?

Best regards,

Graham

PS: I’d really appreciate if you could again hit the “heart” button, to let me know you enjoyed this article. Thank you!

A useful insight Graham. Dominant market share achieved through quality and added value, and therefore a good moat.

What price/sales ratio before a PepsiCo or Diagio take an interest ?.

A nice summary of price vs value conundrums